An ISA (Individual Savings Account) is a tax-efficient way to save or invest

🙂 An ISA is a special kind of savings account where your earnings are protected from being taxed.

For savings, all interest is tax-free; for Stocks and Shares ISAs, investors don’t have to pay tax on any dividends or capital gains.

This article explains the annual ISA allowance, and gives an introduction to the different types of ISAs available.

There are several types of ISA, which have different functions:

Cash ISA is a tax-free savings account

Lifetime ISA (LISA) for the under 40’s, to help with property purchase or retirement

Stocks & Shares ISA is a tax-efficient investment option

Innovative Finance ISA enables investors to earn tax-free interest on peer-to-peer loans

Your Annual Allowance

You get an ISA allowance each tax year (6 April to 5 April), which is £20,000 for 2023-24.

🙂 Every tax year you can put money into one of each type of ISA:

- You can open new accounts.

You’re allowed to open one new ISA of each type, per tax year.

- Or you can contribute to any of the ISAs you already hold.

If for example you have multiple Cash ISAs, you can only pay into one of these accounts each tax year.

- Or rather than opening new ISAs, you could transfer money from existing ISAs into different accounts or to another provider. (However, it’s important to do it in the right way so you don’t forfeit the tax benefits – See Transfers below). Money you move from previous years’ ISAs does not affect your allowance limit for the current tax year.

🙂 You choose how you allocate your allowance

You can pay in anything from a very small sum up to your full £20,000 annual allowance.

You can put the whole £20,000 into one kind of ISA (Cash, Stocks & Shares or Innovative Finance), or you can split your allowance between several different types. Note there is an annual limit to how much you can pay into a Lifetime ISA (£4,000).

Example:

You could split your allowance by saving £10,000 in a Stocks and Shares ISA, £6,000 in a Cash ISA and £4,000 in a Lifetime ISA.

😥 If you don’t use it, you lose it!

Any unused allowance can’t be rolled over to the following tax year.

Even though many people won’t be in a position to take advantage of their full ISA allowance each year, the earlier and the greater the amount you can save, the more tax-free interest you will earn; or if you are investing in a Stocks & Shares ISA, the faster your investments could grow.

Transfers

You don’t have to stick with the same provider every year; you can transfer your ISA funds to another provider or between accounts, including those opened in previous tax years. So it’s a good idea to shop around to compare charges, rates and the range of investments on offer. If you have older ISAs do check interest rates, because many are now very uncompetitive compared with the current best buys.

You don’t have to stick with the same provider every year; you can transfer your ISA funds to another provider or between accounts, including those opened in previous tax years. So it’s a good idea to shop around to compare charges, rates and the range of investments on offer. If you have older ISAs do check interest rates, because many are now very uncompetitive compared with the current best buys.

Transfers do not affect your annual ISA allowance.

If you do want to move your money, use the provider’s transfer process; don’t just withdraw the cash to reinvest, because you would lose the tax benefits on that money. Always check for rules and transfer penalties, to ensure it is possible and worthwhile switching funds.

Cash ISA

A Cash ISA is simply a savings account where you don’t pay tax on any of the interest.

As the income is already tax-free, it does not count towards your Personal Savings Allowance (PSA); for bigger savers, it provides an opportunity to earn additional tax-free interest on top of their allowance.

Like standard savings accounts, Cash ISAs are available in various forms, including instant access, regular savers and fixed term. Flexible ISAs allow you to withdraw money when you need it, and replace it during the same tax year, without it counting towards your annual ISA allowance. So you could opt for easy accessibility to your cash, or a higher return from locking away money, or spread savings over different types of ISAs.

As with other savings, your money is protected by the Financial Services Compensation Scheme (FSCS), up to £85,000 per person, per financial institution.

Find out more:

Cash ISAs – MoneyHelper

How ISAs work, risks & returns etc.

Top Cash ISAs – Money Saving Expert

Links to the best deals

Includes an ISA savings calculator & FAQs

Who Could Benefit from Tax-free ISAs?

ISAs offer clear tax advantages for some savers:

- Bigger savers who will exceed their Personal Savings Allowance (PSA).

- Higher earners who get a lower PSA (or none at all), and are taxed at a higher rate.

- If taxable savings income pushes you into a higher tax band, you would then suffer a reduced PSA and higher tax rate, so tax-free savings could be a better option.

Example:

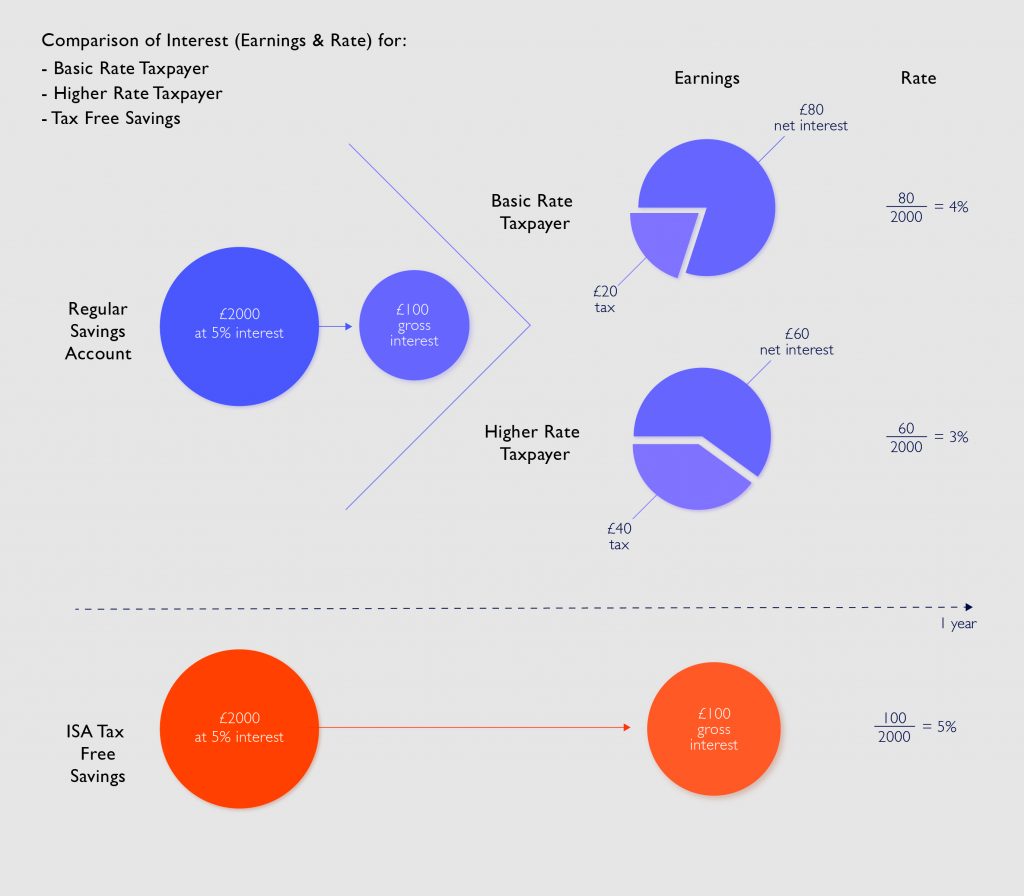

Regular Taxable Savings v Tax-Free Savings – Comparison of earnings on £2000 savings above the Personal Savings Allowance limit:

Are there benefits for savers below their tax-free PSA?

Before the Personal Savings Allowance, Cash ISAs were usually the first choice for savers. But now that most people get all their savings interest tax-free, other higher-paying accounts look more attractive. (ISA rates are often beaten by regular savings and banks’ current accounts).

However, ISAs provide a tax-efficient way to save, so do consider using up your annual ISA allowance if you can. It enables you to gradually build a lump sum of tax-free savings, giving more and more of your money protection against future tax, if circumstances were to change in the longer term:

Economic changes

ISAs have been around for a while now, permanently tax-free and arguably less likely to change than Government policies on savings allowances, tax rates etc.

Also, if interest rates rise, £1000 tax-free PSA will be used up on a smaller amount of savings, so more people will end up paying tax. If that happens, it would be an advantage to have savings in ISAs, where all the interest remains tax-free.

Personal finances

Similarly, if your income goes up and you then have to pay tax on savings, any ISA interest is protected from tax and will not count towards your Personal Savings Allowance.

Lifetime ISA (LISA)

The LISA is a savings scheme for 18-39 year olds, designed to help you buy your first home or to save for retirement (as a possible alternative to a pension).

You can put away up to £4,000 in a LISA each tax year, and the Government will add a 25% bonus on top of what you save, until you reach age 50. (This means up to £1000 a year, totalling £32,000 free cash if you save the maximum amount for the whole period).

However you can only use the money to buy your first home or withdraw it once you turn 60 (and then you can use it however you like). Otherwise, there is a 25% penalty charge for withdrawing money from the LISA (applied to the whole account, not just to the Government bonus). For this reason, some experts suggest that you only open a LISA if you intend to use the money for one of the two stated purposes. It’s also worth thinking carefully before planning to use a LISA instead of a pension, especially if employer contributions into your workplace pension are likely to outweigh the annual LISA bonus you would get from the Government.

Find out more:

Lifetime ISA – Money Saving Expert

With a Stocks & Shares ISA, you can invest in funds, bonds or company shares, and you save tax on income or profits from your investment.

This has become an even more attractive proposition for investors since the Government cut the dividend allowance to £1,000. (This is the amount you can earn in dividends before you start paying tax on them). But ISA earnings remain tax-free.

Whilst stocks and shares can potentially offer higher returns than cash in a savings account, this type of ISA involves the usual risks of investing – the value of your investments can go down as well as up, and you may not get back the amounts originally invested. Be aware of fees and charges for holding and managing investments, which can vary significantly depending on the platform etc., so be sure to consider these costs when choosing ISAs.

Also, investing generally requires tying up money for longer than savings; most sources recommend investing as an option only if you can put money away for 5 years or more, because that allows you to ride out fluctuations in the market, which could otherwise see you make a loss.

You don’t need to invest large sums. You can choose between making regular or ad hoc payments over the tax year, or paying in a lump sum. Some providers allow you to open a Stocks & Shares ISA with regular investments of around £25.

Find out more:

Stocks & Shares ISAs – Money Saving Expert

Need-to-know facts. Is investing right for you? Tips for people new to investing. Find cheap providers.

Innovative Finance ISA (IF ISA)

The Innovative Finance ISA involves peer-to-peer (P2P) lending.

The Innovative Finance ISA involves peer-to-peer (P2P) lending.

As an investor, you lend out your money to individuals, property developers or other businesses, which can include certain crowdfunding projects. They repay the loan plus interest within an agreed time period. And you get to keep the interest, tax-free.

The advantage of the IF ISA is the returns can be high, but it’s much more risky than putting money into a Cash ISA; there’s always a chance that the borrower can’t repay, so you could lose your money. Unlike a Cash ISA, your money is not protected by the Financial Services Compensation Scheme (FSCS), although some providers have set up their own safeguards.

Before you consider the IF ISA, it is important to fully understand the risks of peer-to-peer lending, and it would be sensible to seek independent financial advice to help you understand how your risk profile fits with your long term goals.

Find out more:

Innovative Finance Isas explained – Which?

Find out more about ISAs:

Full ISA Guide – Money Saving Expert

Guide to the different types of ISAs available & which type to pick etc.