If you are thinking about borrowing money, it is essential to understand the total cost involved and what factors affect it. That will help you decide whether it’s wise to take on debt, and if so, how much you can afford, and what type of borrowing would minimise costs and best suit your needs and financial circumstances.

Always do your research and get independent, professional advice for your particular situation.

There are two aspects of borrowing costs to consider:

- You need to cover the monthly repayments

- You must be able to afford the total cost of repaying a debt

Note that the borrowing option with the smallest monthly repayments or the lowest interest rate might not be the cheapest overall!

The Total Cost of Borrowing

Total Cost of a Debt = Amount Borrowed + Interest Payments + Any Additional Charges & Fees

What Factors Affect Interest Payments?

Interest is the cost of borrowing money.

The two factors that have most impact on the cost are the interest rate % (APR) and the length of time you borrow the money (the term). These and other criteria which affect interest charges are explained below:

Interest rate % and whether the rate is fixed or variable

Interest calculation method (simple or compound)

Frequency of adding/compounding interest

Credit rating of the borrower

Amount borrowed

The original sum of money borrowed is known as the ‘principal‘.

The more you borrow, the more interest you will pay.

Interest rate

The interest rate is the fee you pay to borrow money, expressed as an annual percentage of the amount borrowed.

Compare the standardised APR (Annual Percentage Rate) of borrowing options rather than any other quoted interest rate. Generally, for similar length borrowing terms, the lower the APR the cheaper the debt – but always check how much it will cost overall.

Interest rate can be fixed or variable.

Any change in a variable interest rate will cause a corresponding rise or fall in monthly repayments and the overall cost of the debt.

Interest calculation method: Simple or compound

The calculation method will have an impact on the amount of interest charged:

Simple interest is calculated solely on the original amount borrowed, whereas compounding includes interest on previously accumulated interest, so interest payments will be higher and the debt will grow faster.

Simple interest is occasionally used for short-term loans, but compounding is far more common for most types of borrowing.

Frequency of adding or compounding interest

The more frequently interest is added/compounded, the quicker an outstanding debt will grow.

Many personal loans, credit cards and mortgages compound interest monthly, but compounding could be weekly for a payday loan.

Credit rating of the borrower

Your credit rating and financial history determines what sort of risk you represent to lenders, and therefore affects the deal you will be offered. Start building a credit history by establishing a good track record managing your accounts, so you benefit from better deals with lower interest rates.

Repayments schedule

Repayments may be regular or flexible:

- Loans are usually repaid in fixed regular installments, according to an agreed schedule

- Credit/Overdrafts are more flexible with low or no minimum repayments (but generally higher interest rates)

Regular repayments will gradually reduce a debt, accumulating less interest than paying it off in a lump sum at the end of the term. And the more frequent the repayments, the faster you reduce the debt – so you pay interest for a shorter time and save on the overall cost.

Some loans and mortgages have a lock-in clause, which prohibits the borrower from prepaying before an agreed time; you would be charged a penalty for early settlement (e.g. the equivalent of an additional 1-2 months’ interest!)

Length of borrowing term

The term is the length of time you borrow the money i.e. the period over which the repayments are spread. It has a major impact on the overall cost of a debt: The longer the term, the longer your debt accrues interest, therefore the higher the amount of interest added. So always opt for the shortest term you can manage.

Longer-term borrowing might look tempting …

- Interest rates (APR) tend to be lower

- Monthly payments will be smaller if the repayment is spread over a longer period

… BUT the accumulation of interest over a longer period means the total repayment will be higher.

So a loan with a shorter repayment period will probably work out cheaper overall, than one with a slightly lower interest rate. This is why you should not select a product just on the basis of its low interest rate or small monthly repayments – it might work out more expensive in the long run! Always check the total cost.

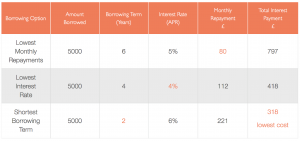

Example:

Comparison of the Total Cost of a £5000 Loan with Alternative Borrowing Options:

- Lowest monthly repayments (spread over a longer borrowing term)

- Lowest interest rate (APR)

- Shortest borrowing term

In this example interest is compounded monthly and no fees are charged

Standardised Interest Rates for Comparing Borrowing Options

It can be tough trying to assess what represents a good deal, when you are faced with so many products, applying various fees and charges, different length terms and quoting monthly, quarterly or annual interest rates.

Compare the APR (Annual Percentage Rate) rather than other quoted interest rates. All lenders must show the APR, which is calculated in a standardised way across all financial products, enabling borrowers to make an easy and fair comparison.

APR (Annual Percentage Rate)

APR shows the total amount a debt would cost if you borrowed the money for one year

APR is expressed as a percentage of the original amount borrowed (the principal).

Example:

If you took out a one year loan of £1000 at 7% APR, you would pay back the loan plus £70.

APR takes into account the interest rate plus any unavoidable costs the borrower has to pay e.g. upfront charges for financing the debt. Charges are spread over the borrowing term and included within the annual rate.

Example:

The quoted interest rate for a loan might be 5% per annum but the APR could be 7%, because the arrangement fee and admin charges add the equivalent of another 2% interest.

APR does not include avoidable charges, like fees for late repayments or penalties for the early settlement of loans.

Note that you won’t necessarily be offered the advertised ’representative’ APR, but lenders must quote the rate that will apply to you. The actual rate charged is likely to reflect the amount and duration of your debt, as well as your credit rating and personal circumstances.

EAR (Equivalent Annual Rate)

For overdrafts, you are more likely to be quoted an EAR (Equivalent Annual Rate), which shows the cost of being overdrawn for a whole year, including the effects of compounding.

Unlike the APR, it does not include any associated charges for going overdrawn e.g. admin fees, so make sure you take these into account.

Additional Charges & Fees

The APR calculation includes unavoidable upfront charges directly associated with financing the debt (e.g. arrangement fees), but it does not include avoidable charges like penalties and fines.

Make sure you read the small print! Terms & conditions vary by lender, so always check exactly what is included in the APR, and what else you might have to pay on top, especially what happens if you miss repayments.

Additional charges and fees can have a big impact on the overall cost of borrowing!

Examples:

- Admin fees

- Penalties for paying off a loan early

- Fees for late or missed repayments

- Payment Protection Insurance (PPI) – cover for repayments in the event of accident/sickness/unemployment.

PPI is not usually compulsory, so it won’t be included in the APR calculation, but some lenders automatically add it to a quote, so you may need to opt out.

Check if you are already covered through other insurance policies, but if not, purchasing standalone insurance is likely to be far cheaper than PPI from a loan company.

Loan PPI – Money Saving Expert

Monthly Repayments

As well as the overall cost of a debt, make sure you can cover the actual monthly amount you need to repay.

Use a Budget Planner to work out what you can afford to repay each month, because that should determine the size of debt you could take on, and also the most suitable type of borrowing.

You can reduce monthly repayments by extending the length of time to repay a debt (the ‘term’). But note that the overall cost will increase, because you will be paying interest for longer.

Check whether the interest rate (APR) is fixed or variable.

Variable rates can go up as well as down – and so will your monthly payments and overall cost!

Keep up with repayments to protect your credit rating and avoid charges and escalating interest.

Budget to set aside funds, and use Standing Orders or Direct Debits to ensure automatic punctual payments.

How to Set up Direct Debits & Standing Orders – Money Advice Service

Before you sign an agreement, lenders must communicate:

The Annual Percentage Rate (APR)

Any additional charges or fees

The monthly payment (if applicable)

The total amount to be repaid

Make sure you fully understand all the terms & conditions

Choosing borrowing options:

Borrow as little as possible… for as short a term as possible

Look for lower APRs on products with similar length terms

Note any additional fees & charges

Work out the total cost over the whole term

Check what (if any) regular repayments are required

Find out more:

How to Work out the True Cost of Borrowing – Money Advice Service

Understand Interest Rates

How interest is calculated, APR etc.

Credit Rating

How to improve your credit rating, to benefit from better deals

Tools:

Loan Calculator – Money Advice Service

Work out how long it will take to pay off a loan, or how much it will cost you.

Change the variables to see how cost and term is affected

Loan Calculator – Money Saving Expert

Work out the cost and find the best available borrowing options