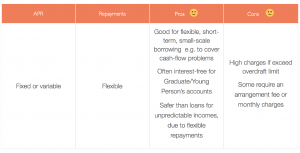

An arrangement where your bank authorises you to withdraw more money than you have in your account, up to an agreed limit or time period

Overdraft Overview

Manage your Overdraft

Safety net

An interest-free overdraft can provide a useful safety net, as you won’t pay extra charges for accidentally going overdrawn.

Stick to the agreed terms!

But don’t go overdrawn without your bank’s authorisation, or exceed the agreed overdraft limit!

Charges can be very high e.g. £25 per transaction.

If you are struggling, talk to your bank and consider requesting a temporary extension.

Clear your overdraft as soon as possible

Once you start earning, try to budget regular repayments to clear your overdraft.

You certainly want to pay it off by the time it ceases to be interest-free and charges and fees apply.

Overdraft debt can affect your credit rating, which may be a problem if you want to apply for a credit card, loan or mortgage.

Find out more:

Overdrafts Explained – Money Advice Service

Always get independent, professional advice for your particular situation.